Credit Consequences after a Short Sale or Foreclosure

No homeowner wants to think about losing their home to foreclosure or undergoing a short sale, but in reality, it does happen. Some lenders would rather accept a short sale, in order to avoid the foreclosure process. A homeowner may rather short sale their home as well, in order to pay off the loan for less than what is owed. In either instance there are repercussions on the homeowner’s credit.

How Short Sales Affect Your Credit

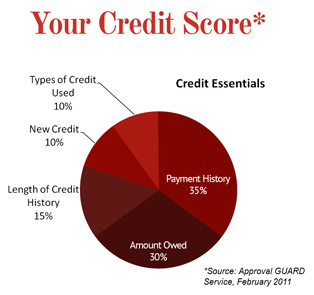

First of all, a short sale occurs when the proceeds from the sale of a house are less than what the owner still owes on the mortgage. When sellers have a home go through short sale, they typically lose 50-100 points on their credit rating. The sellers may wonder about their future home buying power after a short sale as well. Even after losing some of their credit rating, the sellers can typically buy another home in about two years at a good interest rate. Only the late mortgage payments get reported when a homeowner undergoes a short sale.

How Foreclosure Affects Your Credit

In a foreclosure situation, the homeowners lose much more of their credit score than they would in a short sale. The sellers credit score after foreclosure will usually fall 300 points. It will also affect the length of time before a buyer can get a good interest rate when buying another home. After foreclosure it typically takes up to ten years for a borrower to get a good interest rate. Foreclosures must always be listed on any credit application as well. If a homeowner has more than one property that forecloses then their credit could be damaged up to 600 points.

Foreclosure vs. Short Sale

|

Issue |

Foreclosure |

Closed Short Sale |

|---|---|---|

| Credit Score | Score Takes Over 3 Years to Recover – Drops 250-300+ | Score Can Be Recovered in 12-18 Months – Drops 50-150 |

| Credit History | Record Remains 10 Years | Not Reported |

| Security Clearances | Revoked or Terminated | Does Not Challenge Most |

| Current Employment | Re-assignment or Termination | Not A Challenge |

| Future Employment | Most Cases Will Challenge | Not A Challenge |

| Deficiency Judgement | 100% of Foreclosures | Many Give Up Right to Persue Judgement |

| Deficiency Judgement (Amount) | Possible Higher Amount | Lower Negotiated Amount |

Foreclosure vs. Short Sale – The Impact for Future Loans

|

Issue |

Foreclosure |

Short Sale |

|---|---|---|

| Fannie Mae | Ineligible for 5 years | Eligible After 2 years |

| FHA Loan-Late | Ineligible for 5 Years | 3 Years From Date of Insurance Claim Paid to Lender |

| FHA Loan-Current | Ineligible for 5 Years | No Wait |

| VA Loan-Late | Ineligible for 5 Years | 3 Year Wait |

| VA Loan-Current | Ineligible for 5 Years | 3 Year Wait |

| Conventional-Late* | Ineligible for 5 Years | 2 Year Wait |

| Conventional-Current* | Within 7 Years Will Affect Interest Rates | No Wait – But Buyer Must Be Current On All Obligations |

CONTINUE READING Short Sales and Pre-Foreclosure Information

Contact Joe DeLorenzo Broker/Owner of RE/MAX IN TOWN at joe@joedhomes.com or call 609-895-0500 x107.